Store-of-value is a cheap way to make speculation productive; a study in BTC

May 13, 2024

Bitcoin's core value is financial sovereignty. Bitcoin the technology keeps the The Shah from seizing your USD. Bitcoin the axiom lets you purchase the belief that The Shah shouldn't seize your USD. This pairwise connection gives Bitcoin its GDP in the present and its momentum for the future.

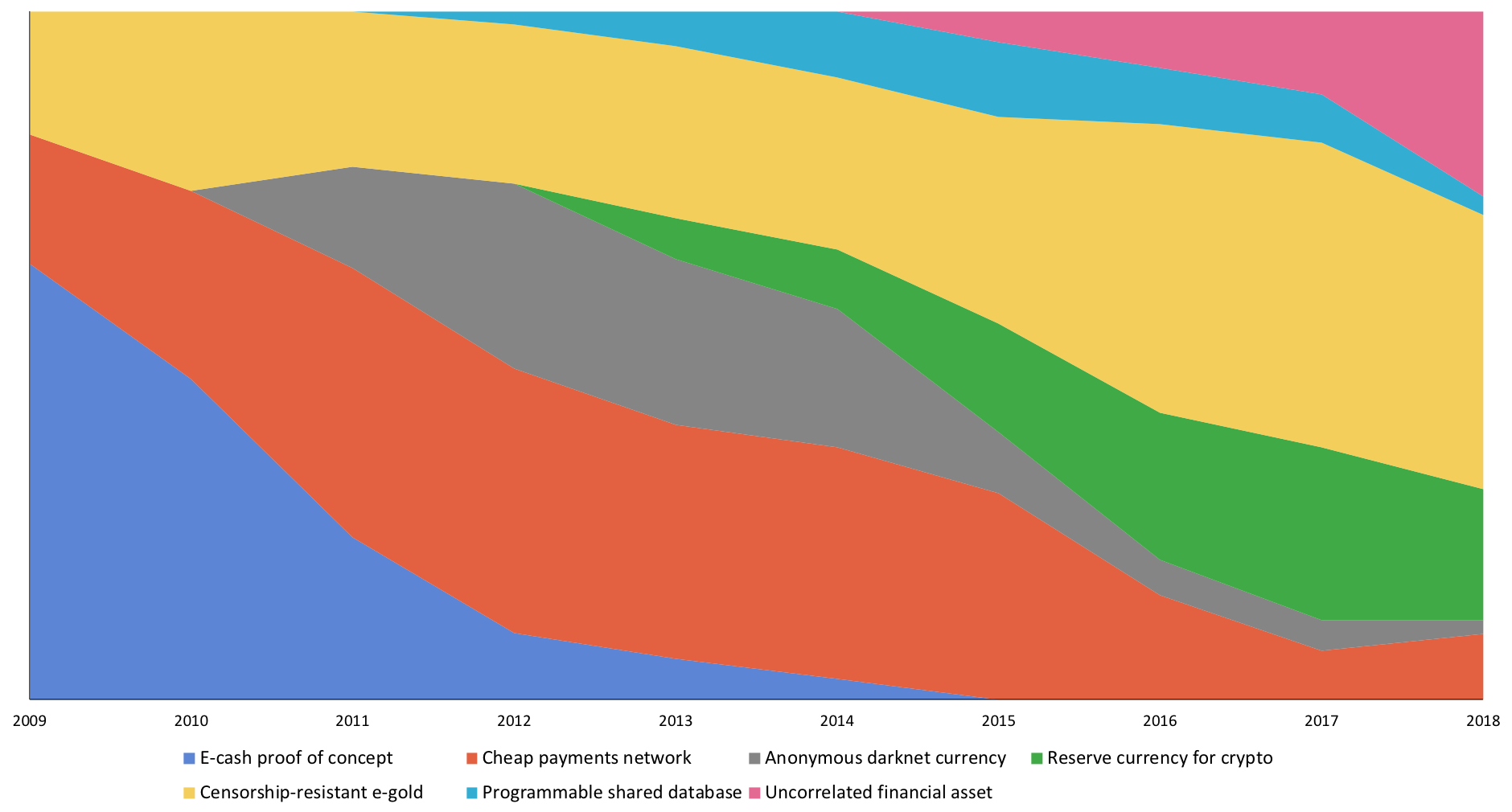

Over time, Bitcoin's promised path to actualizing financial sovereignty has wandered and split across a handful of value propositions, each involving a custom mix of payments technology, privacy, censorship resistance, and value storage. Here, I argue that the success of non-sovereign value-storage as a value proposition can be traced back to the productive use of speculation. Specifically, I look to present a stronger understanding of how non-sovereign SoV uses speculation to align token ownership with contributions to progress, both without a central token allocation body and without fragmentation of community focus, all while contributing to GDP.

Bitcoin value props across time profiled by Hasu and Nic Carter

Speculation can't pay for technical progress

Token value props have two cooperating elements: an observable form of progress and a surface to speculate on the future magnitude of that progress. In BTC's early days, with no historical record and no comparative proof points, it needed progress in the most practical form, and it found digital cash. At this stage, concrete progress is a window of light for skeptics. One does not need an imagination to look at growing payment volumes, extrapolate them to a global payments network, and see value.

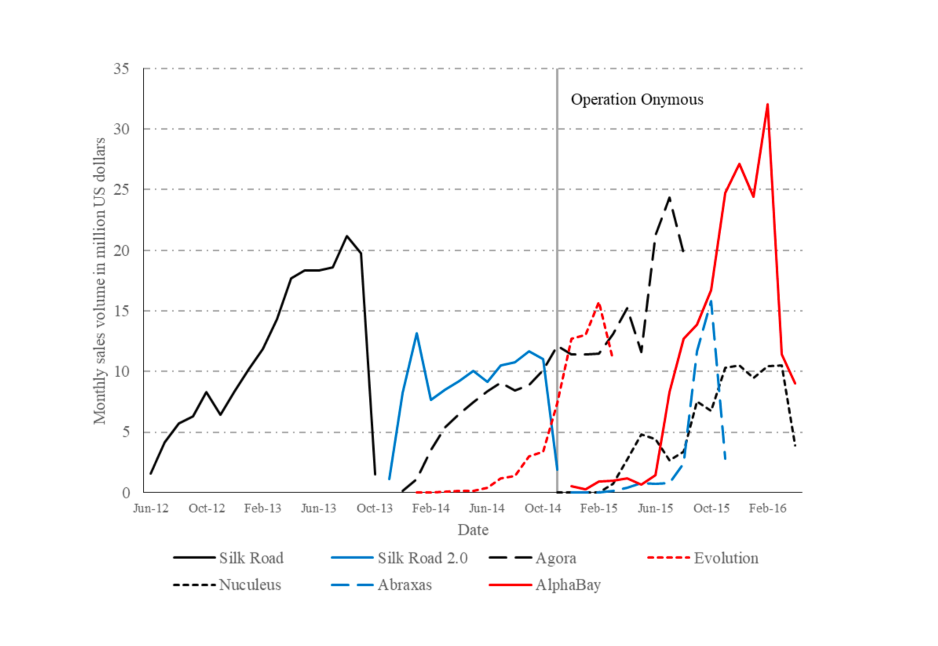

However, tangible progress is often at odds with speculative surface area. Undeniable measurability comes with a sort of restrictive sluggishness when the numbers drop. Darknet markets are bounded by the fact that they're highly illegal, and the existence of BTC as-is was not enough to compel progress in payments beyond pirates and psychonauts.

BTC transaction volumes on major Darknet markets rising and falling with shutdowns.

More importantly, the rigidity of BTC-the-protocol exaggerated the evolutionary unfitness of BTC-the-payments-network. Success as a payments network required a lot of coordinated labor—regulatory intervention, customer education, protocol / application development—and the distribution of the token couldn't pay for it.

BTC was left with a broken progress loop, where payments-labor did not recursively produce enough payments-progress to produce more labor. Luckily for BTC, there existed other value props with much higher fitness.

BTC's value is derived from the perceived strength of its values

BTC has always maintained a conceptual relationship with gold. Today, it seems non-sovereign store of value (SoV) is the community's most relevant promise, blending BTC as a borderless monetary asset with BTC as crypto's reserve currency.

Notably, non-sovereign SoV still makes relevant claims to GDP. Wealth that would otherwise be subject to value-destructive, sovereign intervention can be stashed in a global network of computers, where it can eventually find its way into mobile gaming startups and restaurant chains instead of civil wars and royal estates. BTC also raises the opportunity cost of storing value in sovereign money, putting competitive pressure on nations to provide higher-quality forms of the status quo.

BTC's productivity-increasing resistance to intervention acts as a floor for non-sovereign SoV as a value proposition, but the vast majority of BTC's value delivery comes from the normative values it represents. Here, demand for BTC is a function of the popularity of financial sovereignty as an inherent good and BTC's claim to represent it—a function whose inputs include things like the perceived risk of monetary censorship, restricted civil liberties, and global instability. Moreso than its technology, BTC's values give it the credibility to promise that, in the event of international collapse, it will somehow come to the rescue.

At the extreme, one could view every ounce of tech surrounding BTC as simply a proof point for its values; a means to prove that it cares about financial sovereignty more than an attempt to provide it. After all, given the intrinsically chaotic nature of global central-banking collapse, it's impossible to approximate the likelihood that, given an explosion, BTC remains better off than competing fiat monies, pointing further to the virtuality of its value prop.

We can observe this with a few external proof points. First, the US has higher trading volumes and stronger institutional adoption of BTC than any other country, despite having the world's most reputable currency, strongest technology investment opportunities, and very little monetary censorship (but a high premium on freedom and lots of risk-seeking USD). Second, BTC isn't the most technologically-adaptive non-sovereign money. Eth has a more distributed validator set, better access to financial primitives, and a clearer path to scale, yet BTC's claim to non-sovereign SoV is much more widely recognized in both public dialogue and market cap. Third, adoption of BTC-the-protocol in the wake of price growth and increased circulation does not stick or expand—transaction volumes are directly in line with price.

When value prop = value storage, you get the least noisy labor markets

Without opinionated, long-term token distribution mechanisms (whether from a central org i.e. foundation / labs, or novel protocol mechanisms), token communities are not well-suited to provide labor that is specialized, scarce, or otherwise intentful. Compensation via permissionless token purchases and subsequent value accrual is extremely noisy, as prices are driven by many factors outside of technological progress and protocol adoption. Even in the imaginary case of perfect information and price response, the value accrual from price growth is distributed evenly across all token holders, making any sort of buy-and-improve strategy very low-leverage for all but the largest holders.

However, in this state of nature, token communities are readily equipped to provide labor in the form of speculation. The fitness of Non-sovereign SoV as a value prop comes from its ability to accurately apportion token ownership with respect to speculative labor.

Given that a BTC's goal is to become an ever-larger store of value, progress is measured as the total amount of wealth stored in the token, where additional wealth forfeited in exchange for tokens means additional progress.

If SoV is the progress paradigm, then: total progress contributed is proportional to (∝) total wealth stored in the token ∝ total number of tokens owned.

Here, productive labor means taking wealth that was previously stored elsewhere and shifting it into BTC. In exchange, laborers are rewarded with tokens proportional to the amount of wealth they've shifted with respect to BTC's perceived value at the time of the shift. Under SoV the value prop, BTC's long-term token distribution is strongly aligned with the contributions of community members.

Another way of thinking about this is that—compared to other progress paradigms—SoV maintains the least noisy labor markets.

In search of generalizations to other tokens

BTC is best fit to remain associated with future iterations of financial sovereignty in public thought—it's the most values-adaptive non-sovereign money. This puts it in a uniquely strong position to adopt SoV as a value prop and hold its focus across speculative cycles. The same cannot be said for other nonproductive tokens like Doge.

For me, BTC is meaningful as a model of cryptoeconomic progress because it uses on-chain incentives to compel progress in a way that's both values-aligned and GDP-accretive. BTC can repeatedly create momentum without central intervention because it distributes tokens long-term in accordance with both its values (the world needs non-sovereign SoV) and contributions to progress (more value storage) with respect to its values. For any individual participant: Values alignment ∝ Contribution to progress ∝ Tokens. It just so happens that, because of its market positioning, it can do this in a state of anarchy. Future token allocation models looking to replicate will likely need more opinionated designs.

Of course, Bitcoin's incentive model is not without flaws. The network must maintain a sustainable security model and its current configuration is unlikely to appropriately value that labor. However, given its size and relative decentralization at the layer of adoption, Bitcoin represents the strongest social equilibrium in all of crypto.